2022-05-19

2022-05-19

Over the past two years, DeFi has demonstrated a dazzling wealth effect, attracting money and talent from the traditional financial world. At the heart of this magic show is "decentralization" – replacing complex and opaque centralized financial institutions with open source code. Therefore, despite the twists and turns of the development path (such as being hacked), there are still DeFi protocols that provide a variety of DeFi financial services such as lending and trading.

Since the DeFi boom, countless DEXs have sprung up in the market, allowing people to exchange money in a private and unauthentic manner. Nowadays, the head DEX platform is catering to the development of multi-chain ecology through cross-chain technology!

Currently, the decentralized trading platform Curve's TVL is close to $20 billion, the Curve token is up 82%, followed by Pancake Swap and Sushi Swap, with TVL exceeding $10 billion. In terms of DEX TVL rankings, Curve ranked first with $18.21 billion and compatibility with seven different blockchains. Binance Smart Chain (BSC) DEX app Pancakeswap has the second largest TVL, with $5.77 billion in just one chain alone.

In fact, from these leading DEX data, we can find that the growth of DEXs is amazing, relative to the period of the inception, these DEXs have been greatly improved both in terms of the token market value or TVL, which prove that DEX is currently the most popular decentralized financial protocol in the market, and in the case of better and better market development, there will be more DEXs debuting in the market in the future. Being one of the most promising DEXs in the market in 2022, Libra Swap is ready to go, embarking on the current trend, it is expected to become the next generation of DeFi unicorns! So what about the strategic advantages that Libra Swap is currently demonstrating?

1) First, Libra Swap is backed by the BSC ecosystem

TVL within the DeFi space has now broken through a record $200 billion and is currently spanning multiple DeFi protocols and blockchains

TVL is worth $220.2 billion, and this number is growing every day, accounting for 56% of DeFi TVL on BSC alone, and there are currently hundreds of billions of dollars locked in BSC's network, although Ethereum still has many DeFi projects, but it is clear that Ethereum's own network performance constraints lead to a worse and worse user transaction experience, while BSC is compatible with the existing Ethereum virtual machine EVM (Ethereum Virtual Machine) and all the applications and tools under its ecosystem, in simple terms, the significance is that it can be maximumly compatible with the Ethereum ecosystem, attracting developers and spillover funds on Ethereum.

Libra Swap's choice of the BSC chain highlights its future competitive advantages, the BSC chain regardless of the underlying technology, resource allocation, number of developers, or the ecological scale is so far the leader in the public chain!

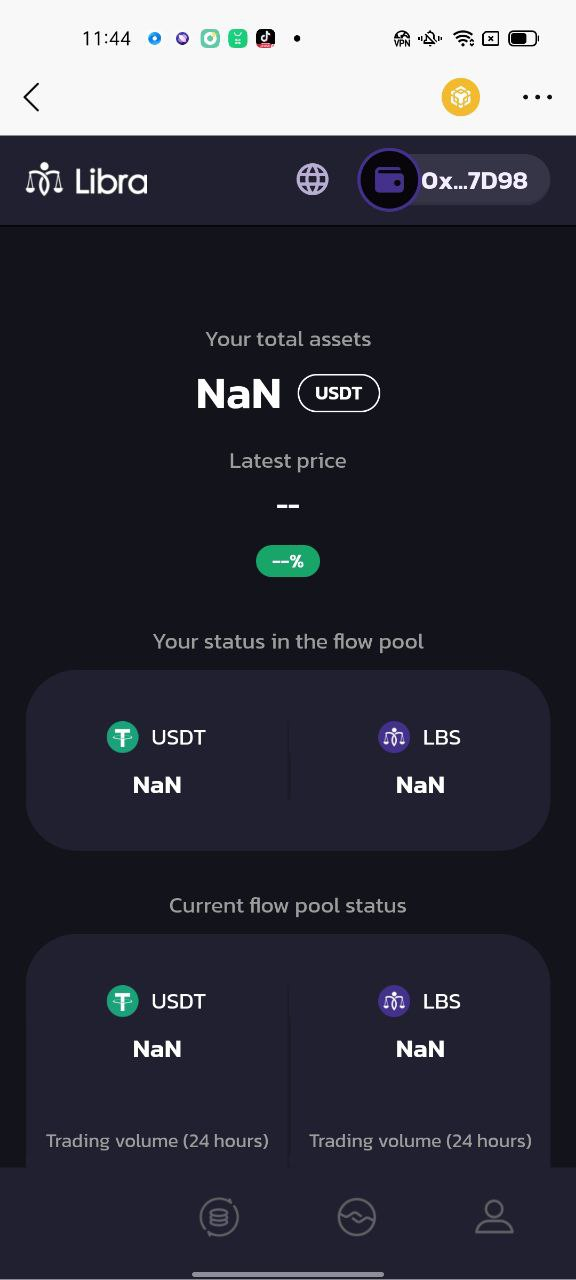

2) Libra Swap is a popular DeFi product

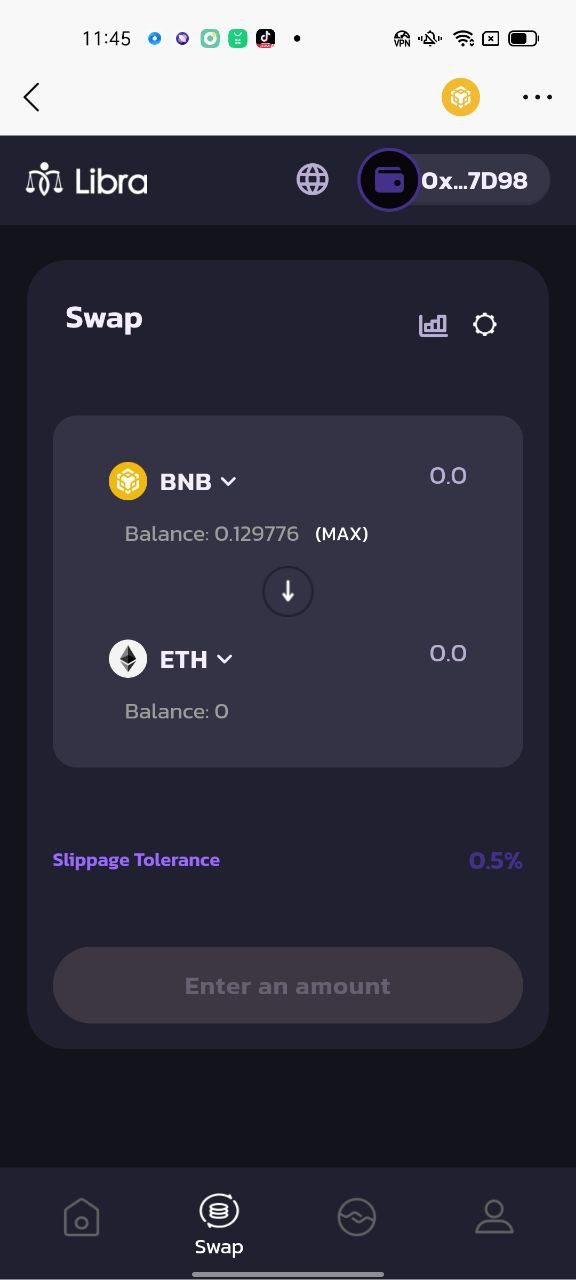

When users are using DEXs, they are nothing more concerned than about the core transaction experience of efficiency, cross-chain convenience and security, and it is clear that Libra Swap is currently more in line with the concept of DeFi2.0 financial protocol products. Libra Swap's DeFi2.0 attributes are reflected in these aspects, which are more efficient, more intelligent and more comprehensive!

Efficiency aspect: Layer 2 is equivalent to changing from a muddy road to a flat vertical highway, by expanding the network layer to obtain TPS data improvement, so that user transactions are not limited to network congestion, Libra Swap developed layer-based expansion engine WFDx, to improve the user's transaction efficiency and the user's capital utilization, so in reducing slippage and impermanence losses!

Intelligence aspect: Based on the composability of DeFi, DEXs can be seamlessly connected with oracles, synthetic assets, layer 2 and other fields. For example, the platform uses multiple oracles to integrate multiple sources to collect data, providing credibility guarantee for the liquidity pool price of Libra Swap. At the same time, Libra Swap uses the self-developed layer 2 technology to improve transaction efficiency. These all reflect the intelligence of Libra Swap in terms of combination, and more technologies and solutions will be incorporated into Libra Swap in the future!

Comprehensive aspect: First of all, Libra Swap promotes the efficient exchange of assets on different chains, Libra Swap builds cross-chain bridges on different chains based on DCRM technology, allowing users to safely carry out token or data inter-transfer operations between different chains, and another point of convergence is that Libra Swap has increased the function of aggregate liquidity, allowing users to save costs when making large transactions in low-flow pools, through optimizing algorithms, spreading trades into the same liquidity pool of trading pairs to avoid high slippage, and providing users with services to optimize prices and increase revenues!

3) DAO, let users closely connect

In DeFi 1.0, not all projects will take liquidity incentives as the entry point, binding the incentive relationship of users in future transactions, although liquidity mining is very common in DeFi 1.0, but this is not the only one, and in DeFi 2.0, this situation will be broken, because DeFi 2.0 will have more liquidity incentives, at present, Libra Swap's liquidity mining is the first way to connect users and bind users. Through the liquidity incentives given by the platform, Libra Swap users will be bound to participate in the liquidity income and other projects of platform development for a long time; in addition, more than 30,000 members of the LBR liquidity mining pool have enabled the DAO's governance model to be smoothly promoted, helping users to obtain great autonomy management authority for Libra Swap, and users can achieve self-control of the community between users. There are also innovative gameplay modes such as asset collateralization and pledge equity mining, which are increasing the close connection between Libra Swap users!

Summary:

At present, Libra Swap is undergoing technical adjustments before going online, we believe that Libra Swap will soon debut to meet everyone, creating a more perfect trading experience for users, in the case of the market and products, Libra Swap will follow the current DeFi boom to occupy the strategic commanding heights of the future!